Transforming Treasury Management for the Digital Age

Transforming Treasury Management for the Digital Age

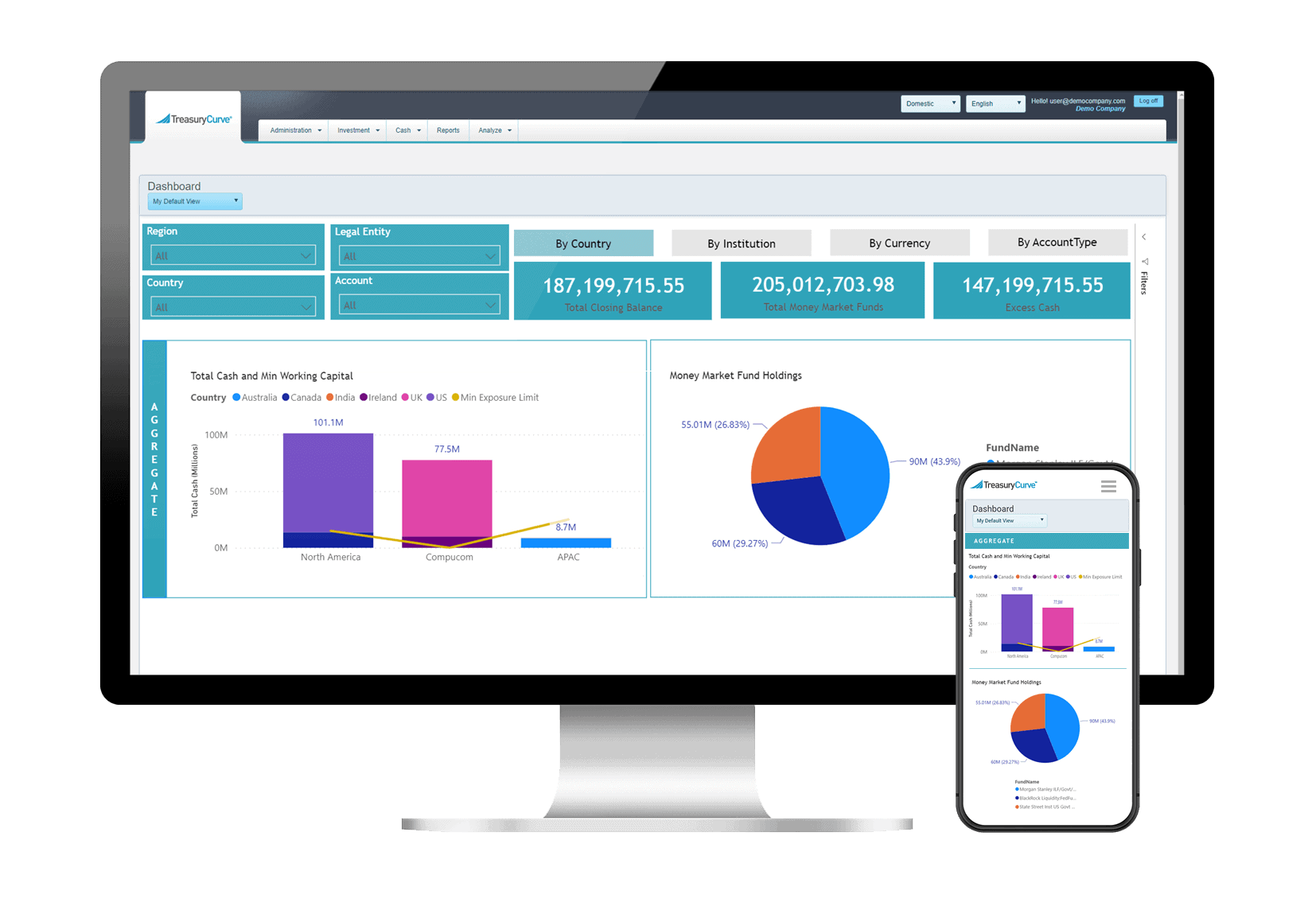

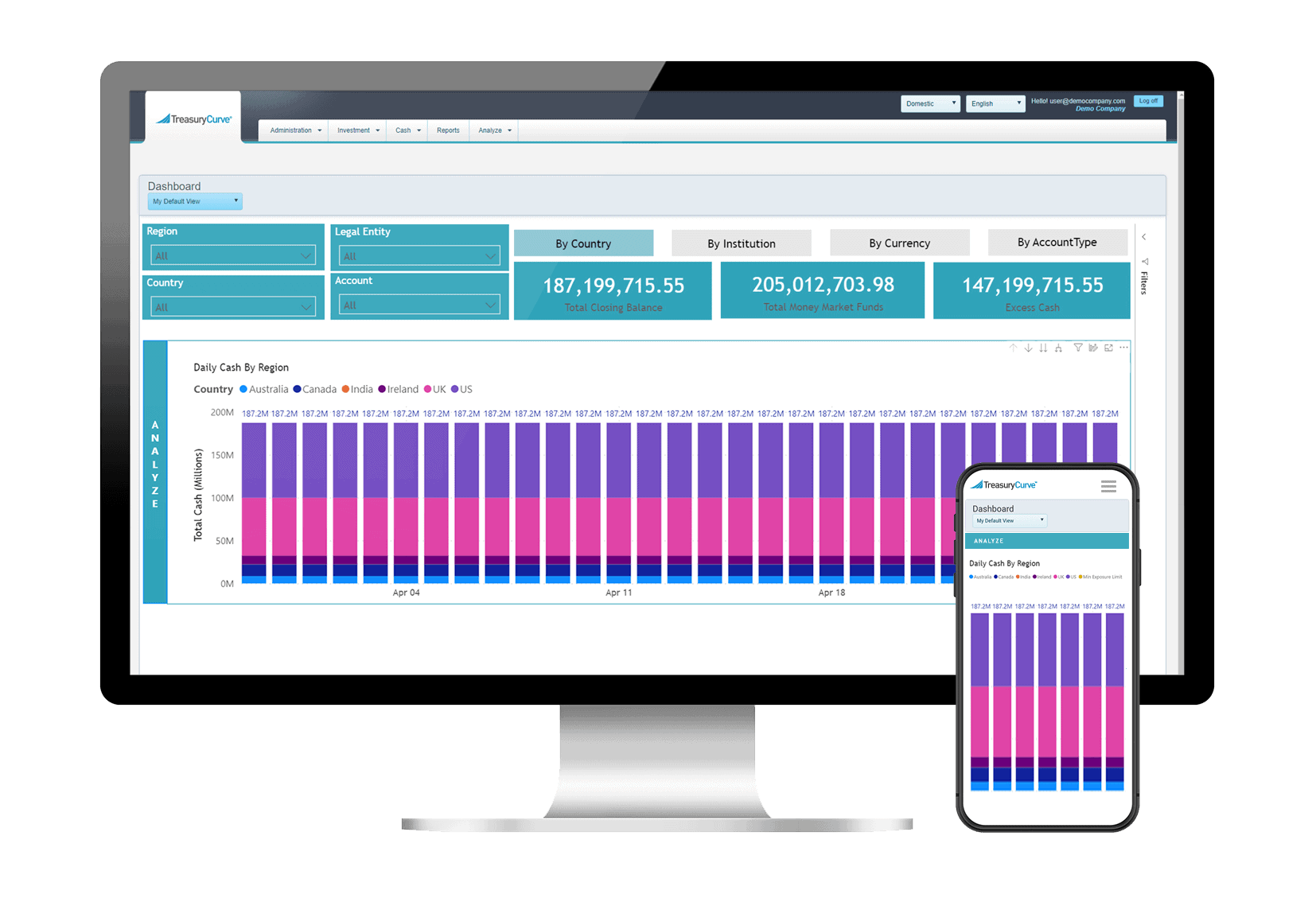

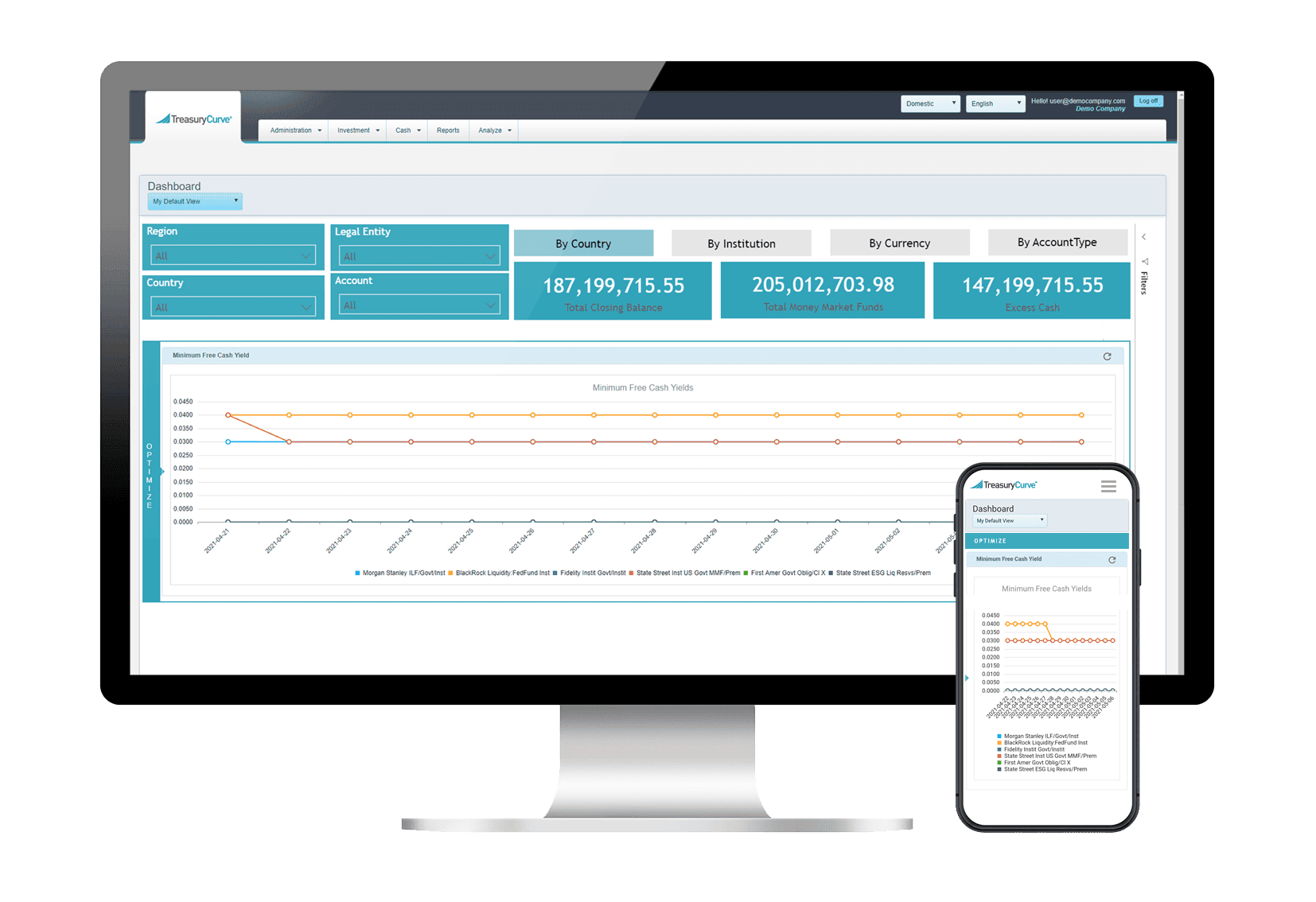

Transactive Treasury Dashboard

Your optimized treasury starts with a Transactive Treasury Dashboard where all who need it can access it, anytime, anywhere, on any device. They can see what they need to see, and do what they want to do, all from “one place” and “one source” that aggregates data from all sources, interacts with spreadsheets and enterprise systems, and embeds workflow and compliance—all in near real-time.

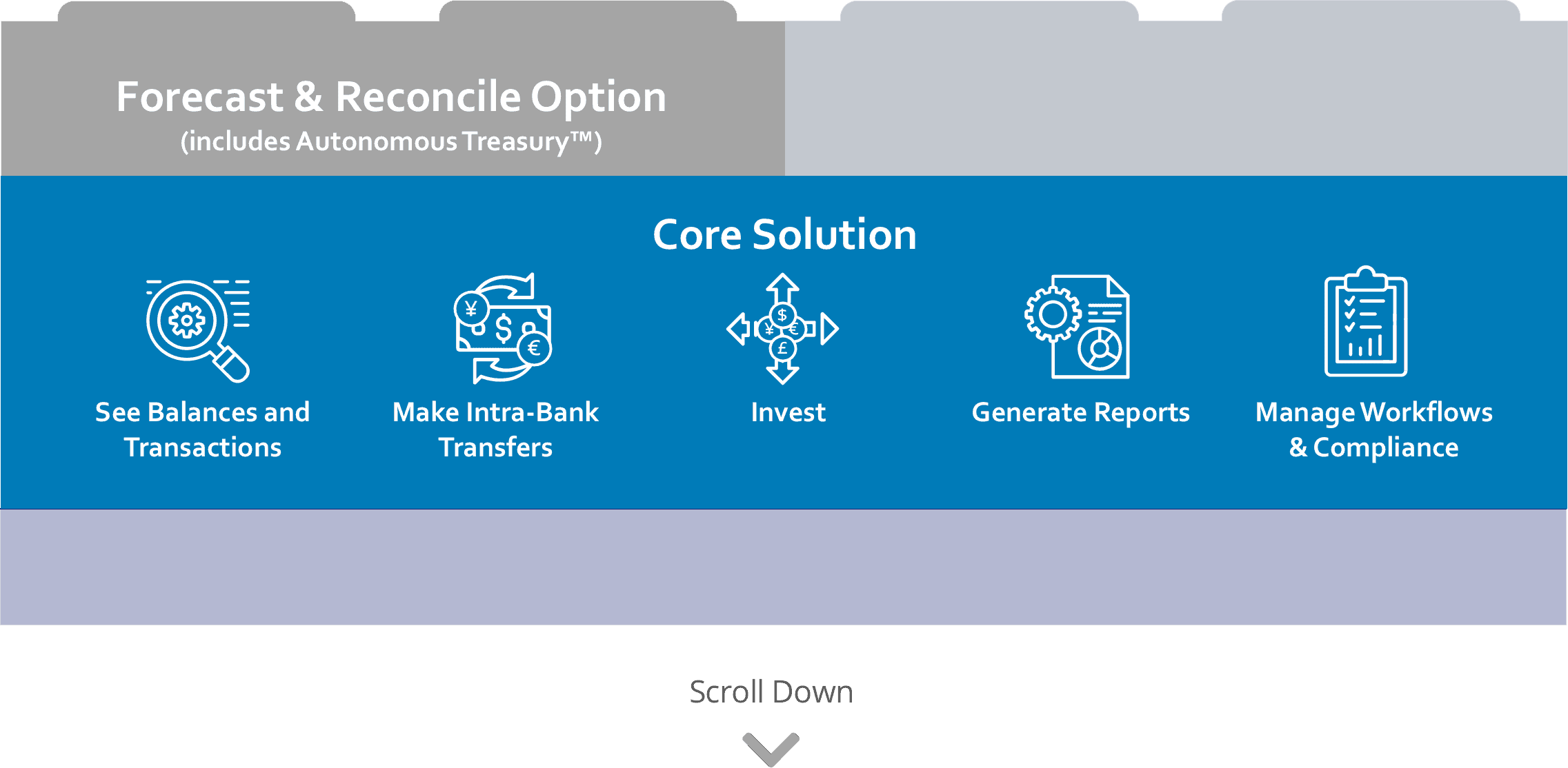

Scalable Treasury Management: Core Solution and Beyond

To enable your Transactive Treasury Dashboard, you start with the Core Solution and add to it as you go.

Scalable Treasury Management: Core Solution and Beyond

To enable your Transactive Treasury Dashboard, you start with the Core Solution and add to it as you go.

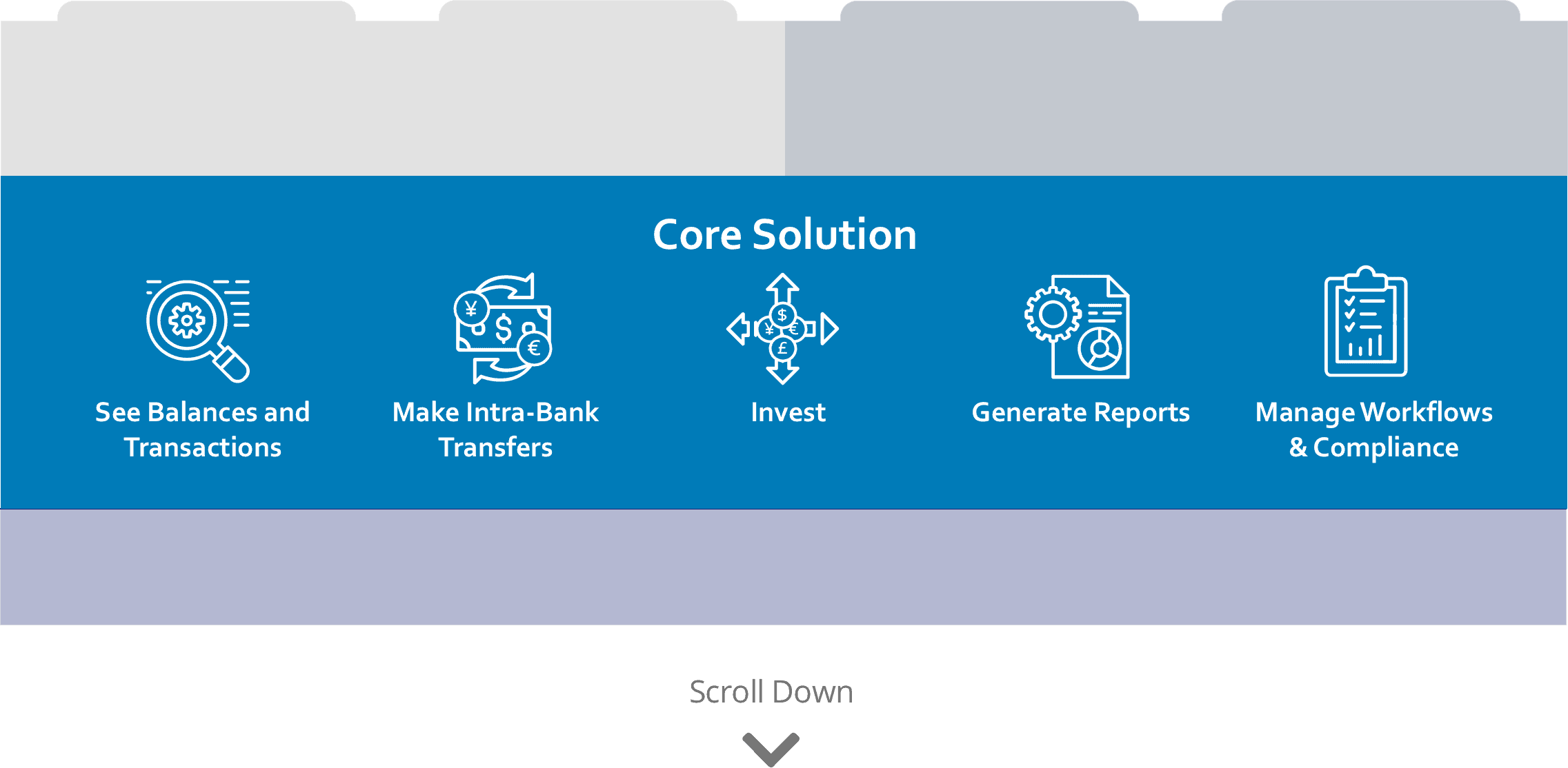

Core Solution

The Core Solution can replace your need to logIn to multiple bank and investment portals. No more looking for or fumbling with multiple passkeys! Additionally, you gain more functionality like the ability to manage your cash and investments in one place, with workflow and compliance embedded, and the ability to easily create customized reports.

Scalable Treasury Management: Core Solution and Beyond

To enable your Transactive Treasury Dashboard, you start with the Core Solution and add to it as you go.

Forecast & Reconcile Option

Many Treasury Curve clients choose to add the Forecast and Reconcile Option immediately after setting up the Core Solution. This option includes Autonomous Treasury™ functionality that brings controlled, intelligent automation to your treasury. This ensures your accounts can be automatically balanced, and free cash invested, all based on limits you control.

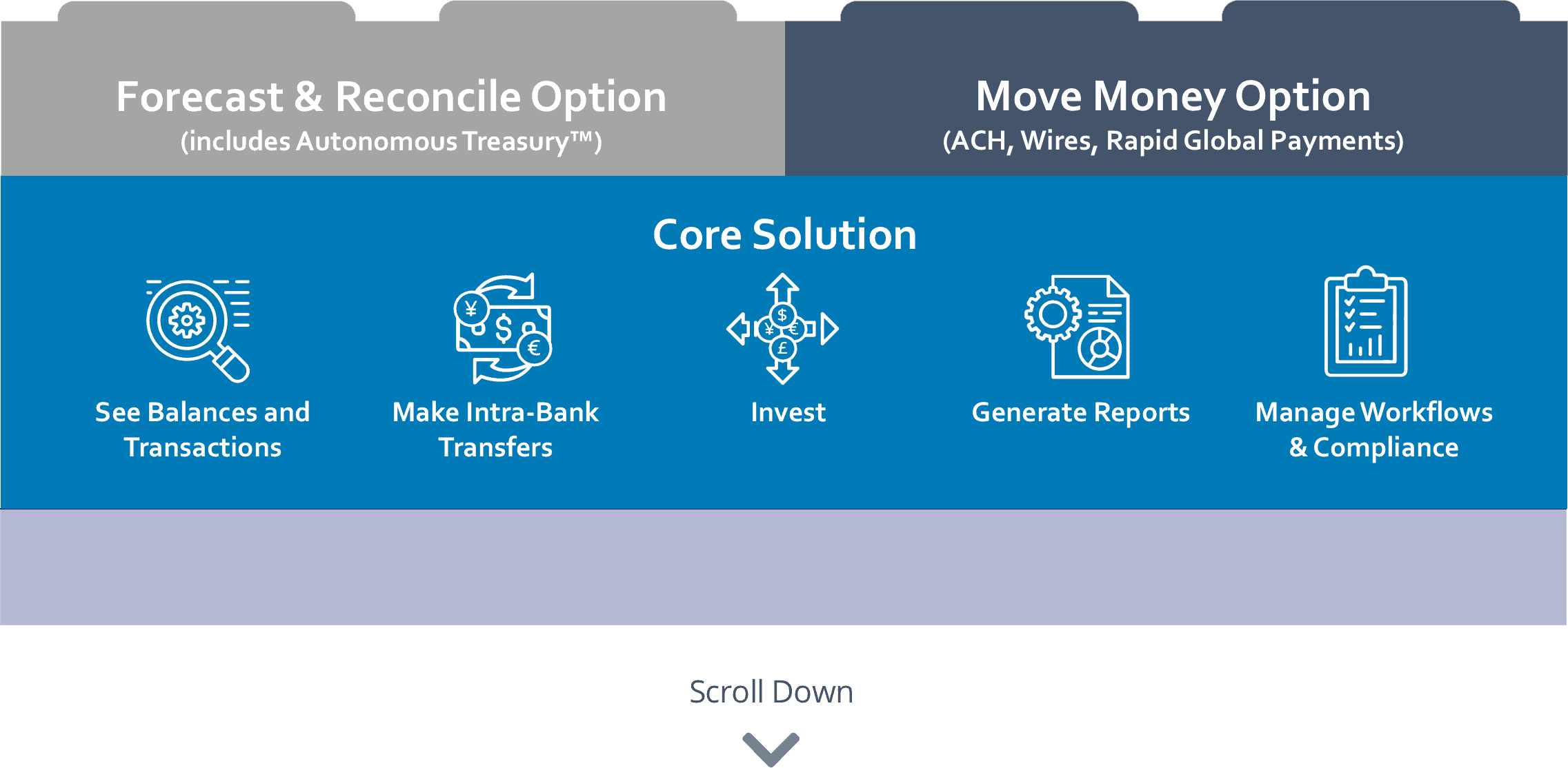

Scalable Treasury Management: Core Solution and Beyond

To enable your Transactive Treasury Dashboard, you start with the Core Solution and add to it as you go.

Move Money Option

This option lets you choose between ACH, Wires and Rapid Global Payments. In addition, Treasury Curve’s collaboration with Visa offers a connection to Visa B2B Connect, enabling affordable, fast, global B2B payments to corporations via participating banks.

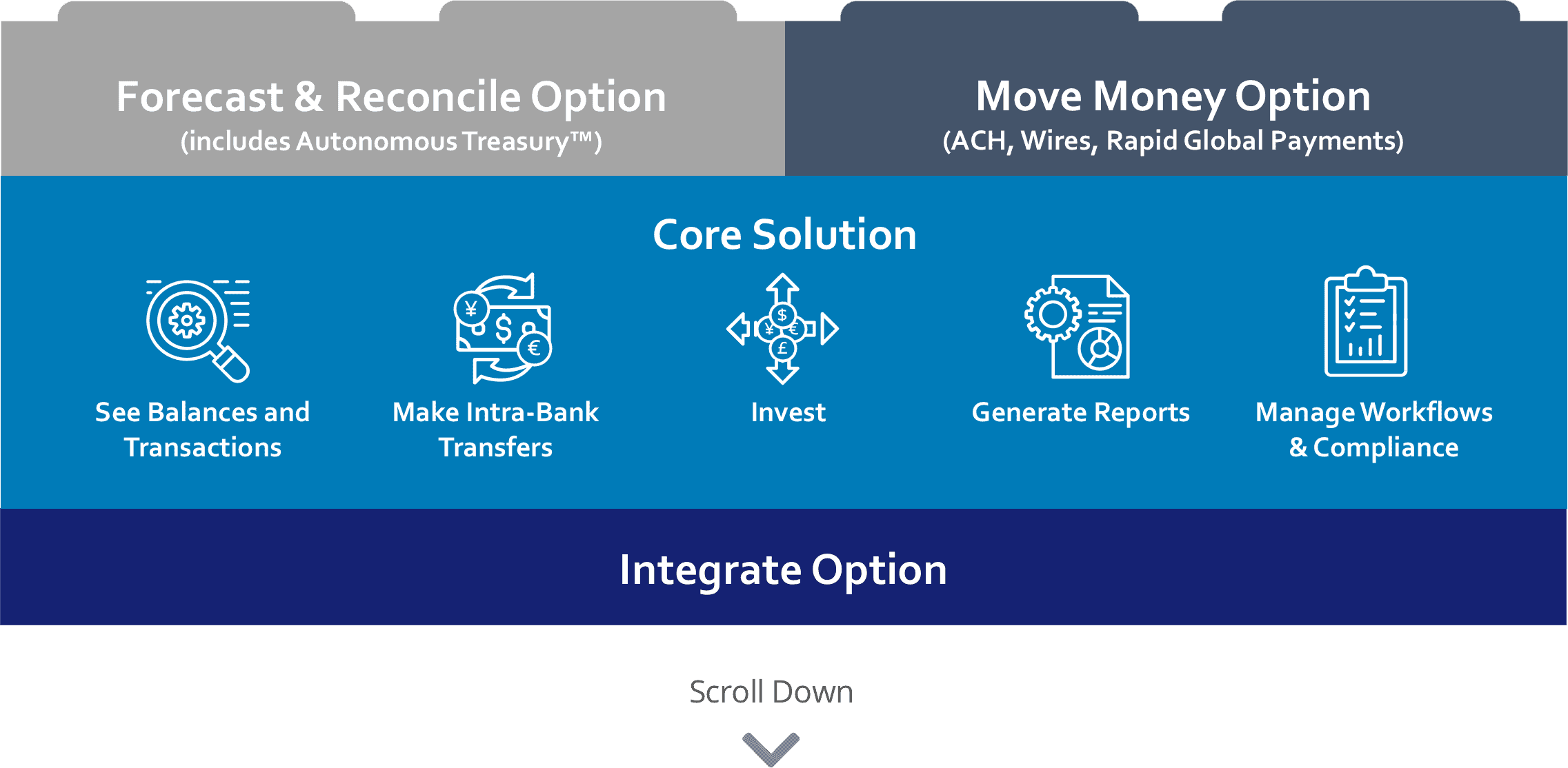

Scalable Treasury Management: Core Solution and Beyond

To enable your Transactive Treasury Dashboard, you start with the Core Solution and add to it as you go.

Integrate Option

At some point, you will want to consider integrating with your ERP for a payment factory and journal entries. That’s something we know you will want over time, and we wanted you to know it is available when you need it.

Receive insights and treasury best practices from the experts.

Sign up for the Monthly Treasury Curve Newsletter

Receive insights and treasury best practices from the experts. Sign up for the Monthly Treasury Curve Newsletter

*Any claims, statements or testimonials may not be representative of the experience of all clients and is no guarantee of future performance or success.

Investments like stocks, bonds, mutual funds and annuities are:

Not FDIC Insured | Not Bank Guaranteed | May Lose Value

Investments in money market funds are not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. While money market funds seek to maintain the value of your investment at $1.00 per share, it is possible to lose money by investing in these funds. The prospectus is available via the link to the asset manager on the Research page in the column entitled Fund Company URL. The prospectus contains more complete information about each Fund including distribution fees and expenses. An investor should read the prospectus carefully before investing or sending money.

Treasury Brokerage, LLC is a registered broker-dealer and a member FINRA/SIPC.

Securities offered by Treasury Brokerage, LLC a member of FINRA/SIPC. | brokercheck.finra.org

1.877.9TCURVE | info@treasurycurve.com