Treasury Curve Payments & Transfers

Simplify & Centralize Your Financial Operations

Treasury Curve Payments & Transfers

Simplify & Centralize Your Financial Operations

Treasury Curve Payments & Transfers is a comprehensive solution that integrates seamlessly with your existing cash and investment management workflows, helping you improve the efficiency of your financial operations, optimize your financial strategies, and ensure security and compliance.

Powerful Features

Treasury Curve Payments & Transfers is a comprehensive solution that integrates seamlessly with your existing cash and investment management workflows, helping you improve the efficiency of your financial operations, optimize your financial strategies, and ensure security and compliance.

Efficiency at Scale

Maximize productivity by centralizing your payment and transfer operations. Our platform automates routine tasks and streamlines approval workflows.

Global Reach, Seamless Transactions

Easily handle domestic and cross-border payments with support for multiple currencies and jurisdictions. Treasury Curve Payments & Transfers ensures smooth, compliant global transactions with built-in regulatory adherence.

Real-time Insights

Gain full visibility into your cash flow and liquidity with real-time reporting and data analytics. Instant access to payment and transfer data helps you make informed, strategic decisions quickly, empowering you to optimize cash management.

Security & Compliance

Safeguard your transactions with industry-leading security protocols. Treasury Curve Payments & Transfers adheres to global regulatory standards, ensuring that your financial operations remain compliant and secure from potential threats.

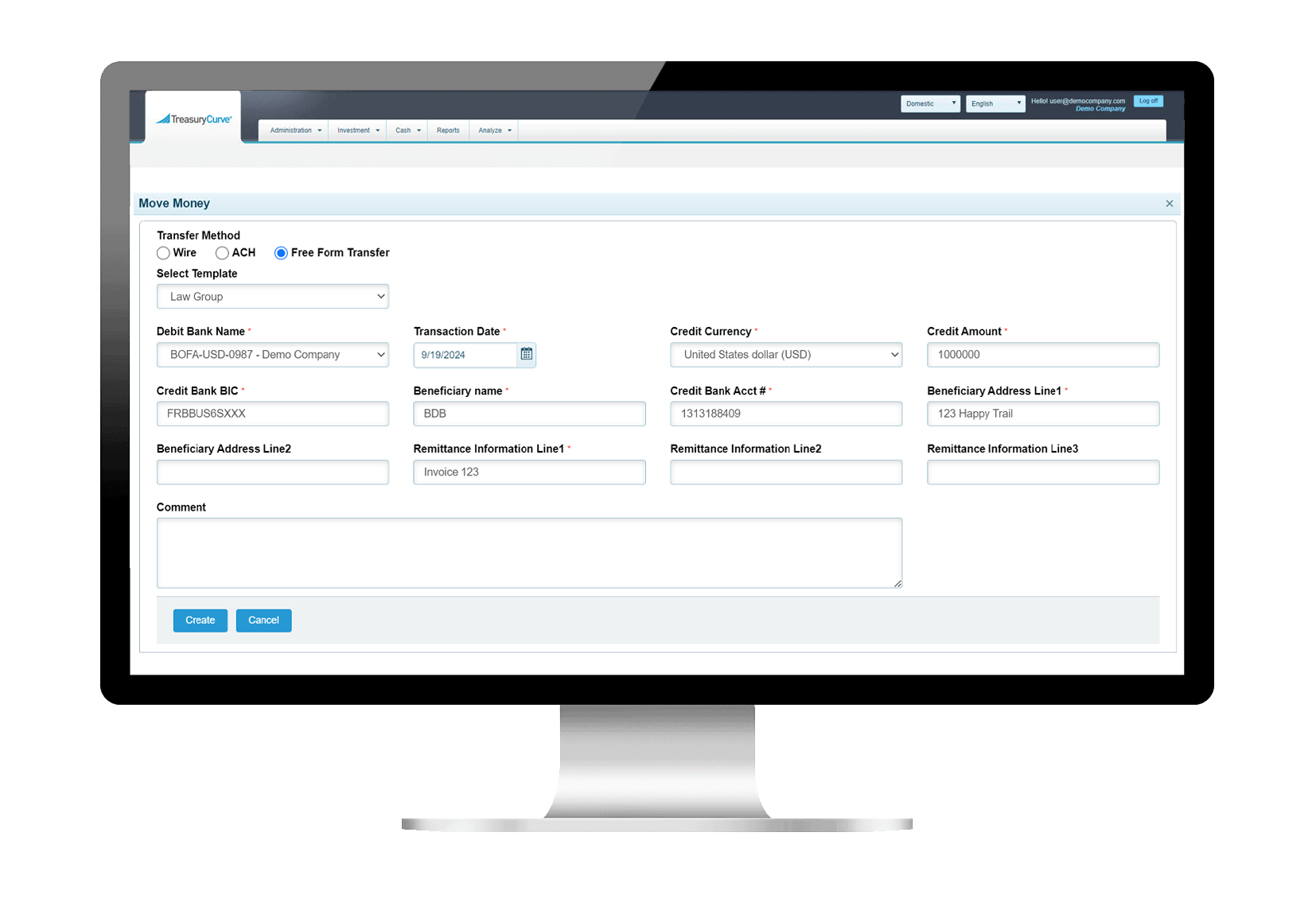

Configurable Workflows

Treasury Curve Payments & Transfers is fully configurable and can be tailored to meet your unique and evolving needs.

Integration

Seamlessly integrate Treasury Curve Payments & Transfers with your existing ERP and financial systems. Our robust APIs and connectors make the implementation process smooth, ensuring minimal disruption to your operations. With Treasury Curve, you can import your forecast, mark your forecasted payments to be automatically executed without having to log on separately to your bank portal, and determine your excess cash and invest it with your trusted providers in compliance with your conservative guidelines.

Value-Driven Benefits

With enhanced decision-making capabilities, top-notch security, and seamless integration, Treasury Curve Payments & Transfers empowers your organization to operate more efficiently and strategically while maintaining the highest standards of compliance and protection.

Centralized Operations

Bring all your payment and transfer activities under one roof, eliminating the need for multiple platforms and reducing complexity

Increased Efficiency

Automate payment processes and minimize manual intervention, saving you time and resources, reducing errors and freeing your team to focus on higher-value activities.

Global Expansion

Scale your business effortlessly with support for international payments, multiple currencies, compliance with global regulations, and more efficient operations.

Enhanced Decision-making

Access real-time financial data that empowers you to make strategic decisions faster, improving your organization’s financial agility and performance.

Seamless Integration

Easily integrate our solution into your current financial systems, facilitating streamlined operations without the need for major infrastructure changes.

Receive insights and treasury best practices from the experts.

Sign up for the Monthly Treasury Curve Newsletter

Receive insights and treasury best practices from the experts. Sign up for the Monthly Treasury Curve Newsletter

*Any claims, statements or testimonials may not be representative of the experience of all clients and is no guarantee of future performance or success.

Investments like stocks, bonds, mutual funds and annuities are:

Not FDIC Insured | Not Bank Guaranteed | May Lose Value

Investments in money market funds are not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. While money market funds seek to maintain the value of your investment at $1.00 per share, it is possible to lose money by investing in these funds. The prospectus is available via the link to the asset manager on the Research page in the column entitled Fund Company URL. The prospectus contains more complete information about each Fund including distribution fees and expenses. An investor should read the prospectus carefully before investing or sending money.

Treasury Brokerage, LLC is a registered broker-dealer and a member FINRA/SIPC.

Securities offered by Treasury Brokerage, LLC a member of FINRA/SIPC. | brokercheck.finra.org

1.877.9TCURVE | info@treasurycurve.com