Treasury Curve Forecast & Reconcile

Master Your Financial Outlook

Treasury Curve

Forecast & Reconcile

Master Your Financial Outlook

Accurate forecasting and seamless reconciliation are essential for making informed financial decisions and ensuring organizational stability. But that’s hard to do as treasurers face the critical challenge of managing and reconciling vast amounts of financial data from diverse sources, including portals from bank and investment providers, ERPs, Excel spreadsheets and more.

Treasury Curve Forecast & Reconcile addresses these challenges head-on by automatically consolidating all your financial data into a single, secure, reliable platform. With access to all this data in one place, and with the right technology to assist you, you are well-positioned to make insights that enable you to optimize your cash and investments, so you are truly making a difference to your organization

Precision Forecasting Tools

Treasury Curve Forecast & Reconcile is an intuitive and affordable platform that is designed to address the complexities of cash forecasting and reconciliation.

Data Aggregation

Consolidate financial data from all your sources – including banks and investments – into one platform for more accurate cash forecasting.

Automated Payments

Click a radio button next to a forecasted payment to automatically initiate payment on that forecasted day.

Advanced Forecasting

Forecast with greater confidence by having all your historical data at your fingertips. We provide you with powerful technology that you can use as your tool to test your assumptions, so you can make decisions to truly impact your organization’s bottom line.

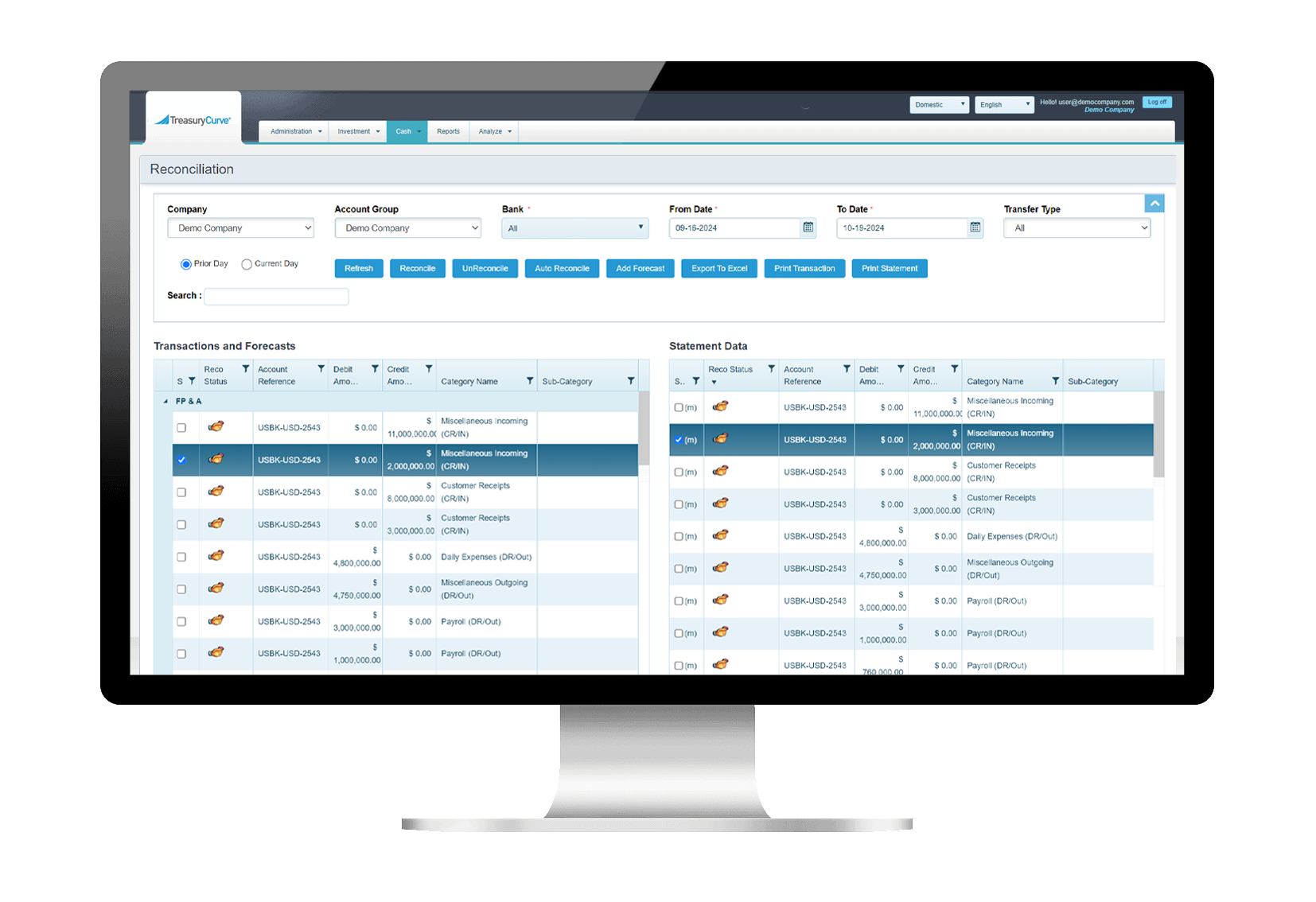

Streamlined Reconciliation Processes

Reconcile your forecasts automatically, all on one screen. You can even reconcile by entering a keyword or an alpha-numeric unique identifier.

Customizable Reporting

Generate detailed reports tailored to your organization’s needs, providing insights into cash flow, reconciliation status, and financial forecasts.

Data Integration

Aggregate and standardize all your data from disparate sources and use our APIs to export data and forecasts to existing ERP and financial systems effortlessly.

Data Accuracy & Reliability

Rely on our platform’s data aggregation to ensure that your financial information is accurate and up to date, reducing the risk of discrepancies.

Strategic Decision-Making Power

Treasury Curve Forecast & Reconcile addresses the critical challenges treasurers face in managing financial data and forecasting cash flows. Experience improved forecasting precision with real-time data and automated processes that streamline reconciliation, saving you time and effort.

Enhanced Decision-making

By aggregating all your financial data into one platform, Treasury Curve Forecast & Reconcile ensures that your data is complete and accurate.

Improved Forecasting Precision

Benefit from accurate cash flow projections based on real-time data, enabling better liquidity management and more strategic financial planning.

Streamlined Reconciliation

Save time and reduce manual effort with automated reconciliation processes, and accurately determine your cash position automatically. Treasury Curve Forecast & Reconcile eliminates the need for you to enter payments into your ERP or bank payment platform, download bank transaction details into Excel, or manually reconcile cash flow forecasts by sorting by date, amount, or purchase order number.

Greater Visibility & Control

Gain a holistic view of your financial data, providing you with greater control and the ability to make more informed decisions.

Efficient Integration

Use our APIs to easily export data to your ERP and financial systems, ensuring a seamless flow of data and enhancing overall financial operations.

Strengthen Regulatory Compliance

Maintain compliance with regulatory requirements through accurate and reliable financial reporting and forecasting.

Receive insights and treasury best practices from the experts.

Sign up for the Monthly Treasury Curve Newsletter

Receive insights and treasury best practices from the experts. Sign up for the Monthly Treasury Curve Newsletter

*Any claims, statements or testimonials may not be representative of the experience of all clients and is no guarantee of future performance or success.

Investments like stocks, bonds, mutual funds and annuities are:

Not FDIC Insured | Not Bank Guaranteed | May Lose Value

Investments in money market funds are not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. While money market funds seek to maintain the value of your investment at $1.00 per share, it is possible to lose money by investing in these funds. The prospectus is available via the link to the asset manager on the Research page in the column entitled Fund Company URL. The prospectus contains more complete information about each Fund including distribution fees and expenses. An investor should read the prospectus carefully before investing or sending money.

Treasury Brokerage, LLC is a registered broker-dealer and a member FINRA/SIPC.

Securities offered by Treasury Brokerage, LLC a member of FINRA/SIPC. | brokercheck.finra.org

1.877.9TCURVE | info@treasurycurve.com