Why Treasurers Can’t Afford to Ignore Modern Money Fund Portals

Why Treasurers Can’t Afford to Ignore Modern Money Fund Portals

For every treasurer, the priorities are clear: preservation of principal and ready access to liquidity always come first. But once those needs are safeguarded, attention inevitably turns to the challenge of managing cash efficiently and capturing incremental yield.

Consider this scenario: A treasurer walks into the office early on Monday. Markets are shifting, liquidity needs are changing, and cash positions from multiple bank accounts and funds are scattered across spreadsheets. To make even the simplest short-term investment decision, they’re forced to sift through manual reports, spanning multiple financial institutions, just to reconcile balances. By the time the data is gathered, and trades are placed, markets have already moved.

Sound familiar?

This is the reality for many treasurers who haven’t yet embraced modern money fund portals and automated cash investment tools. The result? Missed yield opportunities, inefficient liquidity management, and greater operational risk.

Now, picture the alternative.

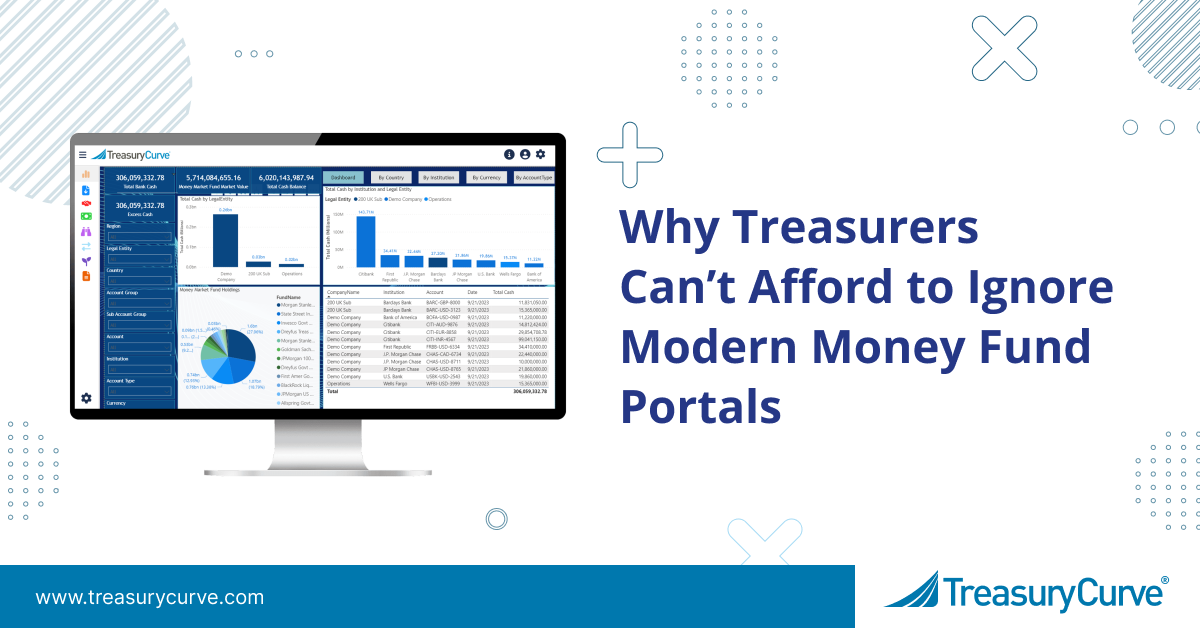

A treasurer who embraces automation and treasury optimization can log into a single portal, instantly see consolidated cash and investment balances, and allocate excess liquidity into money market funds, across multiple, well-known providers with just a few clicks. Automated settlement ensures trades clear without delays, while intelligent investment tools dynamically sweep idle balances into pre-selected funds.

By automating the wire process, treasury staff are freed from time-consuming administrative tasks and can focus on higher-value projects. At the same time, automation helps ensure no settlement is missed – avoiding the significant fees and risks that come with delayed or forgotten payments.

Instead of scrambling, the treasurer spends their day focused on strategy.

That contrast is stark – and it highlights why modern money market fund tools are no longer optional for today’s investment leaders.

How a Money Fund Portal Works

A money fund portal acts as a central hub for researching, investing in, reporting on and managing money market funds. Instead of navigating multiple websites, treasurers gain direct digital access to a broad selection of funds from one screen. Key money fund portal functions include:

- Consolidated access. One login to view and trade across multiple funds and custodians. This eliminates the inefficiency of logging into multiple systems or maintaining different sets of credentials. By unifying access, treasurers can make faster investment decisions without administrative slowdowns.

- Automated trade execution. Treasurers can place trades with a few clicks, reducing time and eliminating manual errors. Manual trade entry can be prone to mistakes that carry costly consequences, while automation ensures accuracy every time. This streamlines treasury workflows, helping finance leaders and their teams focus more on strategy and less on mechanics.

- Integrated settlement. Link directly to the funds so that trades settle automatically, removing the risk of failed transactions. Failed settlements not only disrupt liquidity planning but can damage relationships with counterparties. Automated settlement delivers confidence that funds will always move as intended, on time.

- Real-time transparency. Track balances, positions, and liquidity across all accounts in one place. This visibility enables better forecasting and proactive decision-making. With accurate data always at hand, treasurers can respond instantly to shifting market conditions.

- Intelligent investment tools. The best money fund portals dynamically sweep idle balances into pre-selected funds to put organizations in position to potentially maximize yield without sacrificing liquidity or control. Intelligent cash investments prevent excess cash from sitting unproductive on the balance sheet.

The benefits of a money fund portal are clear: stronger liquidity management, reduced operational risk, and treasury optimization with more efficient use of treasury staff and technology resources.

Why Treasurers Should Care

Preservation of principal and liquidity are always top priorities – and without ready access to liquid cash, opportunities can vanish in an instant. Without the right treasury tools, treasurers risk:

- Idle balances sitting uninvested. Every day that cash remains idle represents forgone yield. Over time, these missed opportunities can amount to millions in lost earnings. Smart automation ensures cash is consistently put to work, strengthening overall portfolio performance.

- Operational errors from manual processes. Manual reconciliations, emails, and spreadsheet updates are prone to errors. Even a small miscalculation or mistyped amount can disrupt liquidity and create compliance headaches. Automating these processes reduces risk and increases confidence in every transaction.

- Limited visibility into true cash positions. Without consolidated dashboards, treasurers often operate with outdated or incomplete information. This lack of clarity can lead to suboptimal decisions at critical moments. Real-time insights empower leaders to act with confidence and precision.

- Difficulty proving control and oversight to boards and regulators. Regulators and boards expect transparency and accountability in liquidity management. Manual processes make it difficult to provide timely, accurate reporting. A modern money fund portal with treasury optimization ensures that treasurers can quickly demonstrate strong governance and compliance.

With the right money fund portal, treasurers are in a better position to preserve principal, ensure liquidity, and see excess return.

Key Considerations When Selecting a Money Fund Portal

Not all portals are created equal. When evaluating a treasury optimization solution, treasurers should prioritize:

- Breadth of fund access. Ensure the portal connects to a wide range of funds, custodians, and banks. This ensures flexibility to diversify investments across different fund families. Broad access also helps treasurers shift allocations quickly in response to changing market conditions.

- Ease of use. The interface should be intuitive for both daily users and occasional traders. A clean, simple design minimizes the learning curve for new users. It also reduces errors caused by confusing layouts or overly complex processes.

- Settlement automation. Verify that the system directly integrates with custodians to eliminate manual intervention. Automated settlement reduces the risk of delays and costly errors. It also gives treasurers greater confidence that trades will close as planned, freeing time for more strategic tasks.

- Intelligent investment features. Look for the ability to automate sweeps and set investment rules that align with your organization’s policies. This helps enforce discipline in managing liquidity while putting you in position to maximize returns. Over time, these capabilities can potentially improve portfolio performance without adding headcount – a treasury optimizer.

- Visibility and reporting. The portal should deliver consolidated dashboards and reporting to meet compliance and oversight needs. Robust reporting tools provide transparency to boards, auditors, and regulators. They also enable treasurers to easily monitor performance and identify emerging risks.

- Security and reliability. Confirm the platform has robust security controls and a proven track record of uptime. Cybersecurity should be a top priority, with strong encryption and access controls in place. High reliability ensures treasurers can trust the platform to function seamlessly when it matters most.

Final Word

For treasurers, managing liquidity without a money fund portal is like navigating in the dark while competitors speed ahead with headlights. The choice is clear: either continue relying on outdated, manual processes – or embrace a treasury optimization portal that provides the speed, transparency, and automation needed to safeguard liquidity and maximize returns.

Contact us now to get started on your journey to safer, more reliable treasury management.

Your cash balances may qualify you for our full suite of technology at no cost. Find out now.

*Any claims, statements or testimonials may not be representative of the experience of all clients and is no guarantee of future performance or success.

Investments like stocks, bonds, mutual funds and annuities are:

Not FDIC Insured | Not Bank Guaranteed | May Lose Value

Investments in money market funds are not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. While money market funds seek to maintain the value of your investment at $1.00 per share, it is possible to lose money by investing in these funds. The prospectus is available via the link to the asset manager on the Research page in the column entitled Fund Company URL. The prospectus contains more complete information about each Fund including distribution fees and expenses. An investor should read the prospectus carefully before investing or sending money.

Treasury Brokerage, LLC is a registered broker-dealer and a member FINRA/SIPC.

Securities offered by Treasury Brokerage, LLC a member of FINRA/SIPC. | brokercheck.finra.org

1.877.9TCURVE | info@treasurycurve.com