Uncategorized

Uncategorized

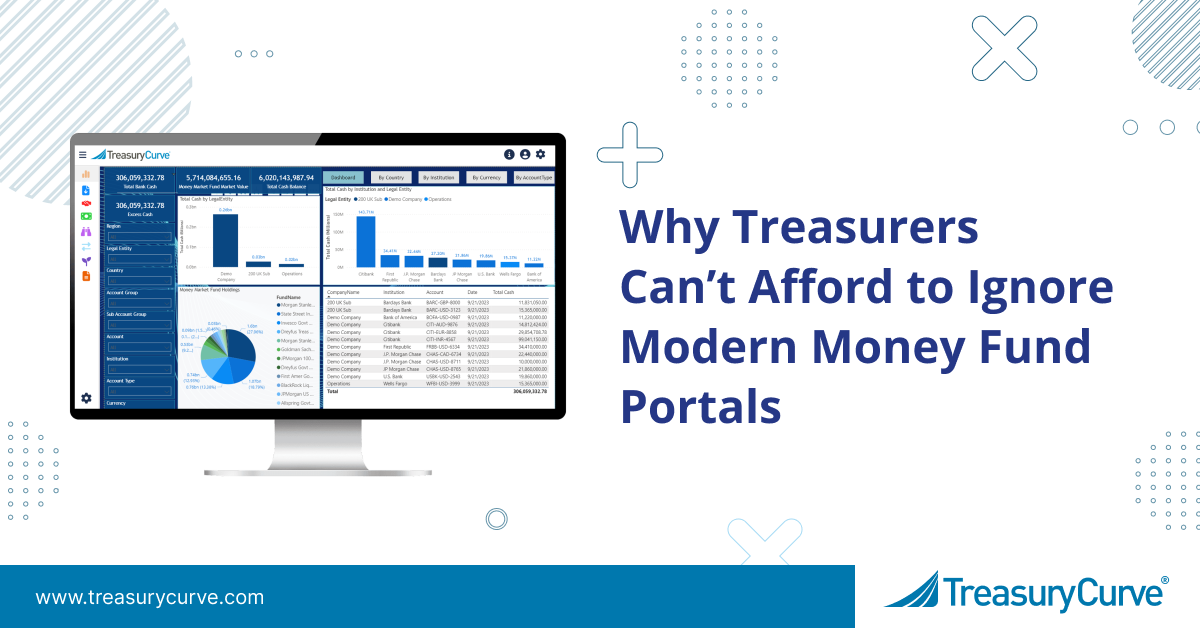

Why Treasurers Can’t Afford to Ignore Modern Money Fund Portals

For every treasurer, the priorities are clear: preservation of principal and ready access to liquidity always come first. But once those needs are safeguarded, attention inevitably turns to the challenge of managing cash efficiently and capturing incremental yield. Consider this scenario: [...]

What the 2025 AFP Liquidity Survey Tells Us About Treasury Priorities

For treasury and finance leaders, few responsibilities weigh heavier than ensuring the organization’s cash is both safe and accessible. The past year has been a reminder that even in times of growth, volatility can emerge suddenly – from inflationary pressures to [...]

Fast-Track Innovation: Why Banks Should Resell a White-Label Money Fund Portal

Financial institutions are under increasing pressure to deliver innovative treasury services, generate new revenue streams, and deepen commercial client relationships. But developing these solutions internally is expensive, resource-intensive, and slow. Meanwhile, FinTechs and larger banks are moving fast, rolling out modern [...]

Flying Blind: Why Lack of Bank Visibility Is Risky Business for Treasury Teams

It started with a missed wire. On a Tuesday morning, a global treasury director logged into one of the five portals she juggles daily, only to realize a time-sensitive vendor payment hadn’t gone through. Not only that, but a sizable cash [...]

The Missed Opportunity: Why Not Offering a White-Label Portal Could Cost Your Bank Business

It started with a conversation that didn’t go anywhere. A business banking client had just asked their relationship manager a simple question: “Do you have an online portal where I can manage my money market fund investments?” The answer was no. [...]

How Treasury Automation Is Like a Great Day at the Beach

What Every Corporate Treasurer Should Be Striving For Picture this: You step onto the sand with the sun on your shoulders, a breeze at your back, and everything you need for a stress-free day at the beach. No scrambling for supplies, [...]

Treasury Tech Red Flags: What Smart Finance Leaders Should Be Demanding in 2025

Your treasury technology could be the weakest link in your financial strategy. In a world where a single missed wire, blind spots in cash and liquidity visibility, or a delayed investment can cost an organization millions, trusting outdated or opaque treasury [...]

The Future of Treasury is Automated: Why It’s Time to Ditch Manual Processes for Good

Economic turbulence. Geopolitical risk. Rising demands from executive leadership. Treasury teams are being asked to do more – with less room for error and even less time to react. Yet many are still relying on spreadsheets and manual processes to manage [...]

Why Poor Communication Is Holding Finance Back—And How Treasury Automation Fixes It

Imagine trying to forecast liquidity or mitigate fraud risk with only part of the picture – and no clear way to communicate or collaborate with the rest of the treasury and finance team. That’s the daily reality for many finance departments. [...]

First-Party ACH Fraud Prevention: Protect Your Firm with White-Label Treasury Solutions

Amid escalating fraud risks and increasingly complex payment landscapes, banks and financial services firms face heightened pressure to protect their organizations from sophisticated scams. One particularly alarming threat is first-party Automated Clearing House (ACH) fraud – where a legitimate customer initiates [...]

Treasury Fraud Risk Management: Why Unified Platforms Are Essential

Treasury and finance professionals, the numbers don’t lie – fraud is on the rise, and your organization is in the crosshairs of bad actors. According to the 2024 AFP Payments Fraud and Control Survey, 80 percent of organizations experienced payments fraud [...]

Why Banks Need a White Label Money Market Fund Portal

The challenge of growing revenues and delivering new client services has never been greater for bank treasury leaders. Clients demand sophisticated tools to manage liquidity and optimize their cash positions. Banks must find ways to meet these heightened expectations while differentiating [...]

Recent Posts

- Why Treasurers Can’t Afford to Ignore Modern Money Fund Portals

- What the 2025 AFP Liquidity Survey Tells Us About Treasury Priorities

- Fast-Track Innovation: Why Banks Should Resell a White-Label Money Fund Portal

- Flying Blind: Why Lack of Bank Visibility Is Risky Business for Treasury Teams

- The Missed Opportunity: Why Not Offering a White-Label Portal Could Cost Your Bank Business

Categories

Your cash balances may qualify you for our full suite of technology at no cost. Find out now.

*Any claims, statements or testimonials may not be representative of the experience of all clients and is no guarantee of future performance or success.

Investments like stocks, bonds, mutual funds and annuities are:

Not FDIC Insured | Not Bank Guaranteed | May Lose Value

Investments in money market funds are not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. While money market funds seek to maintain the value of your investment at $1.00 per share, it is possible to lose money by investing in these funds. The prospectus is available via the link to the asset manager on the Research page in the column entitled Fund Company URL. The prospectus contains more complete information about each Fund including distribution fees and expenses. An investor should read the prospectus carefully before investing or sending money.

Treasury Brokerage, LLC is a registered broker-dealer and a member FINRA/SIPC.

Securities offered by Treasury Brokerage, LLC a member of FINRA/SIPC. | brokercheck.finra.org

1.877.9TCURVE | info@treasurycurve.com